In many consumer markets, companies that once relied on developing new product features and improving customer service increasingly see competitive advantage rooted in the entire experience that’s wrapped around the product.

For a mortgage, many customers care not just about the interest rate and amortisation, but also the ease and speed of the approval process, the quality of the online payment system, and the bank’s service when answering questions or resolving problems that arise over the life of the mortgage. For a laptop computer, some customers might consider ongoing technical support as important as the initial hardware and software. Even as far back as 2014, a survey by research firm Gartner found that 89 per cent of companies expect to compete mostly on the basis of customer experience, compared with 36 per cent four years prior.

This shift in the sources of value pushes managers into largely uncharted territory. While product development has well-worn practices, the realm of customer experience does not. Many firms have not even started to identify their most important experiences, much less manage them. And firms that have tried to enhance the experience often are stymied by the gap between what customers say and the internal metrics reported. In the fog of competitive battle, managers get conflicting reports from the front line: Complaint calls are stacking up, yet all the metrics show that internal processes are working just fine. Those who want to improve the situation often struggle to see the experience through the customer’s eyes, and their hands are tied from removing all the barriers that stand in the way of a terrific experience.

Consider a customer who wants to get home broadband service connected. Typically, one thing she cares about is time. How long must she wait before her Internet is up and running? Will she have to stay home waiting for a technician to appear during a promised four-hour appointment window?

There’s a long sequence of steps involved, from her initial purchase conversation in a retail store or call centre, to the order processed in the back office, all the way to a field-service

Technician hooking up the connection at her house. The broadband provider will know the relevant functional times at each stage — how long the customer waited to talk to a call-centre agent, how long that call lasted, how long the field technician spent doing the job. What the company probably will not know is the cycle time between the customer’s moment of order and when the service starts working — the entire chain of interactions composing this episode, which is what matters to the customer.

A typical customer survey would not shed light on whether the operation was on time or late, cheaper or more expensive than planned, or what were the root causes behind service glitches along the way. The retail unit might see an interaction survey, the call centre might know how long calls took, and the field-service group will measure how long its appointments took. Each has granular data through a narrow, functional lens, but no one has an overall view of the experience. That perspective tends to inform narrow initiatives that do little to improve the overall experience and could actually degrade it. For example, if the retail unit makes an isolated decision to speed up orders, the decision could unwittingly create more errors and remedial work at later stages.

A similar dynamic applies to many other consumer industries. In the credit card industry, a customer who wants to redeem points and finds the bank card website confusing will end up calling an agent. Favourable customer ratings for a helpful agent tell the bank nothing about the poor quality of the overall experience.

SEEING THE FOREST THROUGH THE TREES

Companies that aim to create an excellent experience will have to break this paradigm of functional silos and their associated metrics. They need to analyse the experience through the customer’s eyes, to truly understand what customers feel when they incorporate a company’s offerings into their lives.

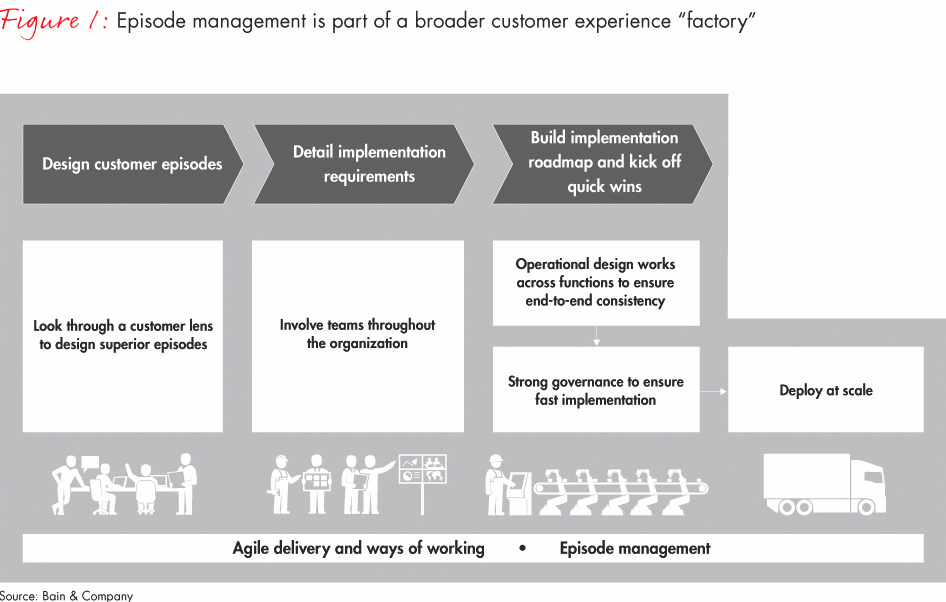

But companies also need a practical way to manage the experience. We are seeing more companies adopt a new key unit of management: the episode, which can encompass a variety of shopping, usage or service activities. Think of a customer experience “factory” in which the company designs and manages key episodes directly, rather than indirectly via functions or departments. Like a widget factory, a customer experience factory employs a repeatable process to design and manage various episodes (see Figure 1). There may be different teams managing the “I need to pay a bill” episode and the “I need technical support” episode, but they should be using the same design and development process, the same customer data and the same management playbook.

EPISODES DEFINED

When customers have a task to complete or a need to fulfill through the company, that’s an episode. It has a clear start and end, marked by the customer completing what he or she set out to do. Episodes range from a single interaction (such as paying a bill online) or an intricate series of interactions spanning weeks (getting fixed broadband service moved to a new home). The sum of a customer’s episodes over time comprise the entire experience of dealing with the company.

Companies that aim to create an excellent experience will have to break the paradigm of functional silos and their associated metrics. They need to analyse the experience through the customer’s eyes.

While short episodes individually have little impact unless something goes wrong, they tend to be more frequent, so they should be easy for customers to transact, with no pebble in the shoe to cause irritation. Longer, more complex episodes, though less frequent, usually contain at least one high-stakes “moment of truth” and thus have a large effect on a customer’s attitude about the company. Choreographing the interactions across all channels to deliver delightful experiences for each episode is difficult, but well worth the effort.

For most companies, episodes can be grouped into three categories:

- Exploration and Purchase: Customers seek information to help them decide which product to choose. This can happen over the phone, online, in a store, talking with friends or browsing a magazine or catalogue.

- Usage: BMW touts “The Ultimate Driving Machine” as its central usage theme. Verizon’s relentless “Can you hear me now?” played up the central benefit of using its network. Driving a car, making a cell phone call, paying with a credit card, and playing a videogame are all usage episodes with the potential to intensely delight or annoy.

- Service: After a customer makes a purchase, immediate service episodes include obtaining a credit card through the mail, or taking delivery of a new car. As customers use the product, common service episodes involve paying bills, getting repairs and resolving a mistake, some of which can be emotionally intense.

By managing episodes directly, companies gain a view of the whole experience rather than just the pieces of the internal process. Both the experience and the economics of the episode become the focus of management team discussions, individual performance reviews, and product and service design projects.

Consider how an episode perspective changes cost-reduction initiatives at a telecommunications carrier. If it targets cost reduction from its technical support call-centre operation, rather than from the entire tech support episode, it could end up with shorter calls or cheaper or fewer agents. That likely would lead to bad tickets of work, pushing more work into the back office and the field, with a higher number of expensive “truck rolls.” A better response might be to add call-centre resources, in order to reduce the number of truck rolls. Similarly, retail banks could reap huge savings by migrating routine interactions — verifying a balance, depositing a check — away from the physical branch and to more efficient and convenient digital channels. For the 25 largest US banks, Bain & Company estimates there is an $11.4 billion cost-savings opportunity if these banks reach the level of mobile and online banking usage of their counterparts in the Netherlands, which adopted digital channels years ago. The US banks would also improve their Net Promoter Score® — a key metric of customer loyalty — by an average of 12 percentage points.

One financial services company is adopting an episode-oriented approach, starting with its digital interactions, but covering all channels. Although the company leads competitors in customer loyalty, the senior team realised it needs to raise the quality of the overall experience, because customers implicitly compare the experience to the best scheme hinges on making thoughtful choices in four areas:

- Define episodes at the right level and focus on those that matter most. The customer’s high-level needs can be broken down into variants of episodes. For example, banks can usefully separate the overall need of “make a payment” into “pay another person,” “pay a bill” or “make an international transfer”. Each is defined by what the customer wants to do, with a clear start and end, and each consists of several underlying processes to redesign and improve. Emotional impact, frequency and economics should be considered when selecting key episodes. Some episodes such as opening a new account or obtaining a mortgage have a big effect on the customer’s perception at the moment, but they occur infrequently. More mundane episodes might be more important in influencing customer loyalty, because they occur so often. If the process for paying a bill online is clunky and slow, it will persistently annoy customers and erode their loyalty over time. Managers should also determine which episodes comprise a large share of overall costs.

- Charge agile teams with continuous improvement of episodes. Many companies have experimented with agile methods for software and digital projects, but agile also works well to manage an entire episode as long as it exists, with responsibility for the quality and efficiency of the episode. As many as 10 members drawn from each relevant function gather in co-located, cross-functional, self-organising units to improve the episode in two-week sprints. Besides their agile work, members remain part of their function as well. While digital processes and channels typically play a big role in customer episodes today, the agile team oversees all elements of the episode across all channels, including the relevant policies, processes, communication and even product feature changes. That’s why agile teams must be cross-functional.

- Install clear metrics and high- velocity reporting. While individual metrics will vary depending on the episode, most fall into one of three categories. Episode frequency, or the rate per customer, is particularly important for negative events, such as a credit card being declined at the point of sale. It might also be relevant for some positive episodes, such as redeeming reward points. Episode quality could include such metrics as speed to completion, resolution of a problem at the first contact, and Net Promoter Score for that episode relative to competitors. Episode economics could include the all-in cost to complete the episode and the change in customer lifetime value. The benefits of a sharply improved fraud-management system, for instance, include avoiding not only the fraud, but also the lower spending from customers due to repeated disruptions. Measuring cycle time also comes into play for many episodes, because a fast cycle time shows there were no errors that required costly rework.Reporting done frequently and with little lag allows the employees responsible for the episode to track performance closely, discern root causes of any problems, and make adjustments quickly. The different departments involved in the episode can understand how they contribute to the broader goal. Financial reporting of episode economics allows senior managers to see how upstream investments can yield downstream savings that generate a strong return on investment.

- Assign strict accountability for each episode. The shift in perspective does require governance that transcends current boundaries of department or function. Functional management rarely holds one or two executives accountable for a particular episode. Many people play a role, but the buck stops with no one. Episode management, by contrast, makes accountability explicit.Governance might rest with a current executive, or it might require a new role. One telecom carrier created a new role to oversee the episode of “installation of a new landline,” because of the technical complexity and numerous departments involved. Each of the departments, though, still is held accountable for the success of this episode, as measured through episode NPS®.One effect of strict accountability is how it simplifies decision making. The executive held responsible for improving the experience and reducing the cost of an episode will be highly motivated to understand how the episode really functions and where to allocate resources. The sum of a customer’s episodes over time comprise the entire experience of dealing with the company. Choreographing the interactions across all channels to deliver delightful experiences for each episode is well worth the effort.

giving employees and partners too much leeway, but these risks are often overblown. Employees can have freedom within a framework. And management can devote time to ensuring that employees understand the company’s mission so clearly that they will consistently act for its benefit.

When the experience matters as much as the core product, companies will need to work harder to earn their customers’ loyalty and advocacy. They can do that by delivering great episodes, reducing costs in the bargain.

A Bain & Company report. Gerard du Toit, Rob Markey, Jeff Melton and Frédéric Debruyne are partners with Bain & Company’s Customer Strategy & Marketing practice. Markey is the global leader of the practice. They are based, respectively, in Boston, New York, Melbourne and Brussels.

Net Promoter Score® and NPS® are registered trademarks of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.